Meeting the Financial Requirement for the UK Spouse or Partner Visa

Share this:

An Essential Part of a Successful UK Spouse or Partner Visa Application

Whether you are planning to join your partner in the UK or are already in the UK and wish to apply for (or switch to) a visa to remain with your partner in the UK, one of the requirements that needs to be met is the financial requirement.

The Financial requirement of a UK spouse/partner visa, which depending on your/your partner's current financial situation, can be the most involved of the requirements when it comes to gathering and providing all the relevant documents to demonstrate that you meet it.

That is not to say that it carries more importance than all of the other requirements, as ultimately all of them must be met. However applicant's and their sponsors usually find this one to take up the most time and focus as the documents required are usually time sensitive in relation to when you will be submitting the application.

What is the financial requirement for a Partner Visa?

From 2012, the Immigration Rules contain a financial requirement to be met for visa applications of eligible family members to come to the UK and join/remain in the UK with a British citizen or settled person.

Although there are exemptions, this financial requirement must be satisfied by meeting the minimum income threshold.

For those making their first application as a partner applying under Appendix FM the current threshold is a gross annual income of £29,000.

Previous Income Threshold

For applicants that are already on the partner route and were originally granted leave as a spouse/partner before 11 April 2024 and are extending their visa, the minimum income threshold is £18,600 gross per annum. This threshold increases to £22,400 where you are applying to extend with a dependant child, and then further increments of £2,400 for each additional child you are applying with (up to a maximum threshold of £29,000).

As well as meeting the minimum income threshold, you will also need to prove that you have adequate accommodation for all members of the family without recourse to public funds. This is whether it just be for the 2 of you, or several of you where there are children to be included as well as other family members that may currently reside in the respective property.

Meeting the Minimum Income Threshold

There are several ways the minimum income threshold can be satisfied, such as follows:

- Income from salaried or non-salaried employment

- Income from self-employment, or income as a director or employee of a limited company in the UK

- Non-employment income, for example, from property rentals, child maintenance, or dividends/income from investments, stocks and shares.

- Money from a state (UK or foreign), occupational or private pension

It is also possible to factor in any cash savings in order to meet the threshold, but would only be considered under the following criteria:

- Only cash savings over £16,000 will count towards this (the first £16,000 of any savings is not factored)

- The cash savings must have been held for at least 6 months

When factoring savings to make up any shortfall of annual income to meet the minimum income threshold, it must be 2.5 times the amount of the shortfall between the gross annual income and minimum income threshold. - More about why and how to calculate this will be covered later.

For applications being made outside the UK i.e. the applicant is applying for entry clearance/leave to enter to join their British/Settled Partner in the UK, the applicant's income will only be considered for the following income sources:

- Cash Savings

- Non-employment income

- Pension income

Otherwise, only the Sponsor's income can be used to meet the minimum income threshold (for entry clearance/leave to enter applications).

All income from the actual partner applicant can be relied on to meet the income threshold, when the application is being made inside the UK and they currently hold a valid visa which allows them to work in the UK, for example if an application to

extend an existing spouse visa is being made while they are in the UK.

Exemption From Meeting the Financial Requirement

Where the British or settled spouse/partner is receiving certain types of benefits or allowances in the UK, there is an exemption from meeting the minimum income threshold and in this case, "adequate maintenance" must be proved. Benefits/allowances that fall under this include:

- Carer’s Allowance.

- Disability Living Allowance.

- Severe Disablement Allowance.

- Industrial Injuries Disablement Benefit.

- Attendance Allowance.

- Personal Independence Payment.

- Armed Forces Independence Payment or Guaranteed Income Payment under the Armed Forces Compensation Scheme.

- Constant Attendance Allowance, Mobility Supplement or War Disablement Pension under the War Pensions Scheme.

- Police Injury Pension.

Adequate accommodation must still be proved however in this instance.

What if the Financial Requirement Can't be Met?

If you do not meet or are not exempt from meeting the financial requirement for spouse/partner visa, you may still be able to apply for a visa or extend your current permission to stay in the UK under the following grounds:

- Your child is a British Citizen or has lived in the UK continuously for at least the 7 years and it would not be reasonable to expect or be in the best interests of the child to leave the UK; or

- There would be very significant difficulties which would be faced by the applicant or their partner in continuing their family life together outside the UK.

- There are exceptional circumstances that refusal of your application would be deemed a breach of your human rights.

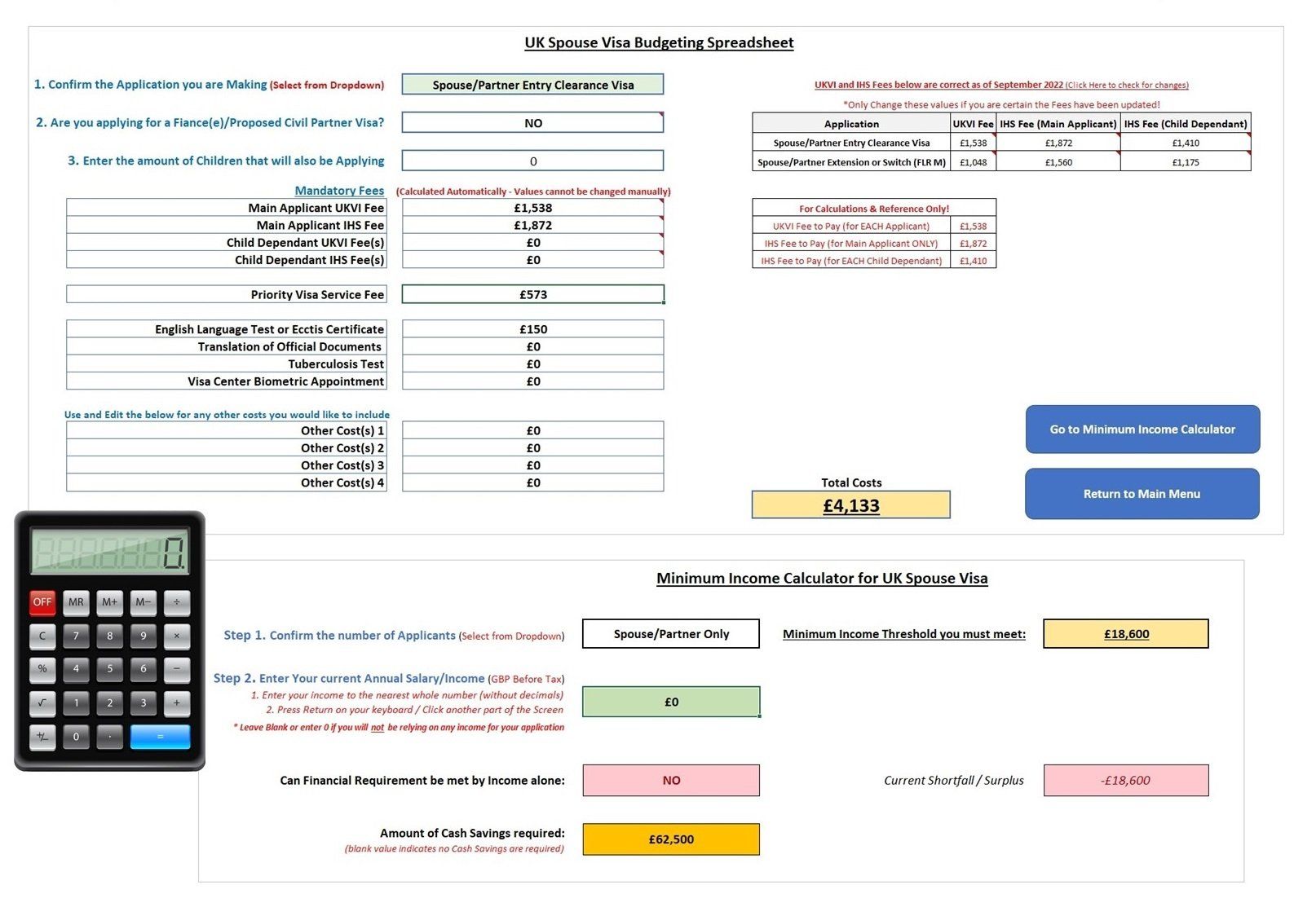

How to Calculate the Amount of Savings Needed to meet the Minimum Income Threshold

As previously discussed, it is possible to include cash savings in order to meet the minimum income threshold. However, there is a specific way the Home Office calculates this which can be better explained with a few examples: (For the first 2 examples, we will use

the threshold of £29,000 gross per annum, which is

applicable to

new applicants)

Example 1: You have no form of income, and will only use cash savings to meet the income threshold.

In this instance you would require a minimum of £88,500 in cash savings to meet the threshold of £29,000.

This is because, the first £16,000 cannot be counted and then the minimum income threshold of £29.000 must be multiplied 2.5 times.

The multiple of 2.5 is because this is the amount of years the visa is granted for.

So 2.5 x £29,000 = £72,500, £16,000 must then be added to this which =

£88,500

Example 2: Your annual gross income is £25,000 so you are short of meeting the minimum income of £29,000 by £4,000.

The difference of £4,000 must be multiplied by 2.5 times, which equals: £10,000. You must then add £16,000 to this amount which comes to

a total of £26,000 of savings needed in addition to your £25000 annual salary to meet the minimum income requirement.

Example 3: You are applying to extend your partner's current spouse/partner visa and the minimum income threshold of £18,600 applies to you. Your annual income is exactly £18,600, but you are applying for an extension of your partner and also a child dependant, which means the minimum income threshold increases to £22,400 (£18,600 plus £3800 for the child). You are therefore short by £3,800.

The difference of £3,800 must be multiplied by 2.5 times, which equals: £9,500. You must then add £16,000 to this amount which comes to

a total of £39,750 of savings needed in addition to your £18,600 annual salary to meet the minimum income requirement.

Other Requirements for a Spouse/Partner UK Visa Application

As well as the financial requirements, to apply for a spouse visa you will also need to satisfy other criteria such as:

- Both you and your partner must be over 18, and your partner must be either a British citizen, have settled status in the UK or have refugee leave or humanitarian protection in the UK.

- You must prove your relationship is genuine and subsisting. If you are married or civil partners, it must be a valid marriage or civil partnership. If you are applying as a fiancé(e) or proposed civil partner, you have the intention of marrying/becoming civil partners within 6 months of coming to the UK, and you and your partner must intend to live permanently in the UK.

- You will need to prove you have good knowledge of English (either by way of an academic qualification or by taking an English test),

Share this:

While every effort has been made to ensure that the information and law contained in this article is accurate and current as of the date of publication, we accept no responsibility for its accuracy or for any loss or damages arising from accessing, or the reliance, of this guidance.

Please also note that the information does not represent a complete statement of the Law and does not constitute legal advice.

If you would like specific professional advice about your UK immigration matter, please consider booking a consultation or one of my other legal services.

Making a UK Visa or Settlement application can be a stressful experience, and whilst there is a lot of ‘free’ information online, finding clear expert guidance that is up to date, and in line with your specific requirements can be a daunting task.

If you have any concerns about your case, it is recommended to reach out for advice from a trusted legal professional.